Could a Multi-Generational Home Help You Afford Homeownership?

webadmin • July 16, 2025

Could a Multi-Generational Home Help You Afford Homeownership?

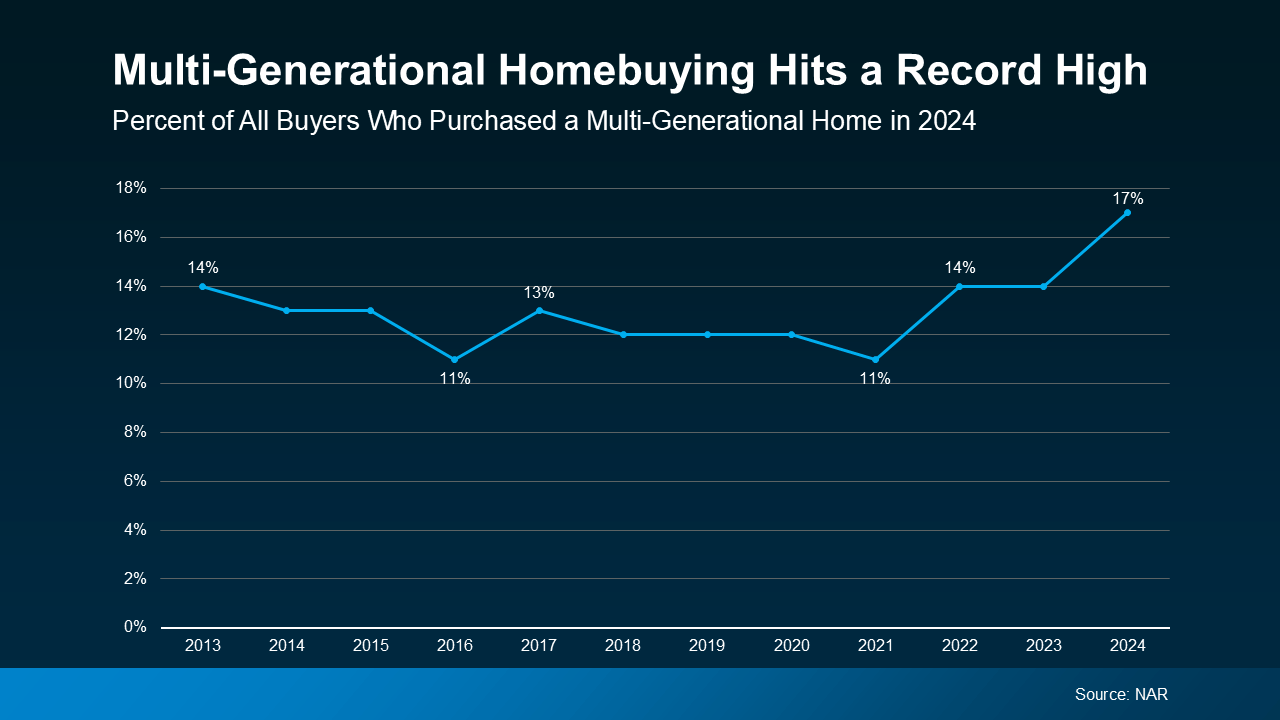

Multi-generational living isn’t just a passing trend but is instead becoming a go-to strategy for today’s homebuyers. According to the National Association of Realtors® (NAR), 17% of buyers purchased a home to share with parents, adult children, or extended family. That’s the highest share ever recorded.

So what’s fueling this shift? In one word:

affordability.

NAR reports that “in 2024, a notable 36% of homebuyers cited ‘cost savings’ as the primary reason for purchasing a multigenerational home — a significant increase from just 15% in 2015.”

A decade ago, the top motivation for multi-generational living was usually caregiving, specifically for aging parents who needed support. That’s still important, but with today’s higher home prices and mortgage rates, saving money has officially taken the lead.

That’s why more families are coming together to pool their financial resources. By combining incomes, you can qualify for a larger loan, afford a better property, and still have breathing room in your budget. You’re not just sharing a roof, you’re sharing the costs of the mortgage, utilities, taxes, and even maintenance.

And this isn’t just about scraping by either, it can also help you afford more home than you could on your own. That means more bedrooms, more bathrooms, or even space for a home office or in-law suite.

It’s clear that multi-generational housing is becoming popular again, with nearly 3 in 10 homebuyers saying they’re considering a multi-generational home for their next move.

A local real estate agent and lender can help you figure out if this is the right strategy for your situation and guide you every step of the way.

Would you consider teaming up with family to buy a home? Let’s connect and talk through your options. Together, we’ll find the path that works best for your future.

NAR reports that “in 2024, a notable 36% of homebuyers cited ‘cost savings’ as the primary reason for purchasing a multigenerational home — a significant increase from just 15% in 2015.”

A decade ago, the top motivation for multi-generational living was usually caregiving, specifically for aging parents who needed support. That’s still important, but with today’s higher home prices and mortgage rates, saving money has officially taken the lead.

Pooling Resources Can Make Homeownership Possible

For many people, the dream of owning a home feels just out of reach, and unfortunately the numbers back that up. Rising home values and interest rates have pushed monthly payments higher, which makes qualifying on your own more difficult.That’s why more families are coming together to pool their financial resources. By combining incomes, you can qualify for a larger loan, afford a better property, and still have breathing room in your budget. You’re not just sharing a roof, you’re sharing the costs of the mortgage, utilities, taxes, and even maintenance.

And this isn’t just about scraping by either, it can also help you afford more home than you could on your own. That means more bedrooms, more bathrooms, or even space for a home office or in-law suite.

Planning Ahead: Finances and Family

If you’re thinking about buying a multi-generational home, a little financial planning can go a long way. Here are a few tips to help make the transition smoother:- Set clear expectations early. Decide upfront how the mortgage and other expenses will be split and put it in writing. This avoids misunderstandings down the road.

- Consider everyone’s credit and income. When you apply for a mortgage together, lenders will consider everyone’s finances, so it’s a good idea to check credit scores and debt-to-income ratios beforehand.

- Plan for the long term. Think beyond just buying the home. What happens if someone’s income changes? Or if one family member wants to move out in a few years? A financial advisor can help you plan for these scenarios.

- Work with a knowledgeable lender. Not all loan programs are the same and some may work better for multi-generational households than others. A lender who understands your goals can help you find the right fit.

It’s clear that multi-generational housing is becoming popular again, with nearly 3 in 10 homebuyers saying they’re considering a multi-generational home for their next move.

Could This Be the Right Move for You?

Buying a home with family isn’t just about saving money, it’s about creating a living arrangement that works for everyone. For some, that means making space for grandparents. For others, it’s giving adult kids a place to land while they build their own financial footing. And for many, it’s just a smart way to stretch your budget and make homeownership happen sooner.A local real estate agent and lender can help you figure out if this is the right strategy for your situation and guide you every step of the way.

Bottom Line

If your budget feels tight, buying a home with family could be a creative, practical way to reach your homeownership goals.Would you consider teaming up with family to buy a home? Let’s connect and talk through your options. Together, we’ll find the path that works best for your future.