How To Buy a Home Without Waiting for Lower Rates

webadmin • February 24, 2025

You’re not alone if you’re hoping mortgage rates will drop before buying a home. But will they? According to expert forecasts, rates are expected to decline—but not as much as many buyers were hoping for.

The good news? Even if rates don’t drop significantly, you still have options to make homeownership more affordable.

The good news? Even if rates don’t drop significantly, you still have options to make homeownership more affordable.

How Much Will Rates Drop?

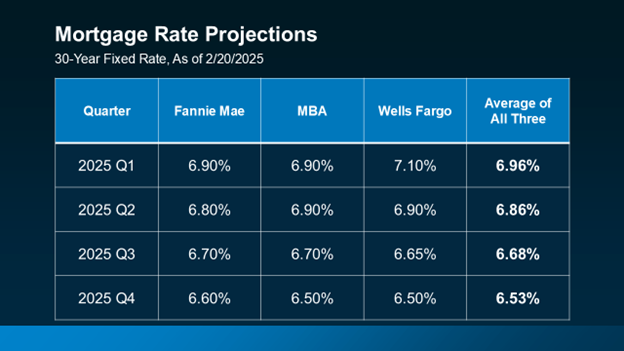

A few months ago, experts predicted mortgage rates could dip below 6% by the end of the year. But recent projections from Fannie Mae, the Mortgage Bankers Association (MBA), and Wells Fargo suggest rates will likely settle between 6.5% and 7% instead (see below).

If you’ve been waiting for a dramatic drop before making a move, you may be waiting a while. And if life changes—like a new job, a growing family, or a major move—are pushing you toward homeownership now, waiting might not be an option.