What’s Ahead for the Housing Market in 2025?

Luminate Marketing Team • July 24, 2025

Your Mid-Year Forecast

Assuming you’ve been paying attention, you have likely noticed that the housing market has already seen a few changes this year. But what’s next? Whether you're buying, selling, or just staying informed, we have a few insights on what experts are saying about home prices, mortgage rates, and what it all means for your next move.

Price growth is slowing down, but that doesn’t mean prices are falling off a cliff. According to the National Association of Home Builders (NAHB) :

Translation? The market’s cooling, not crashing.

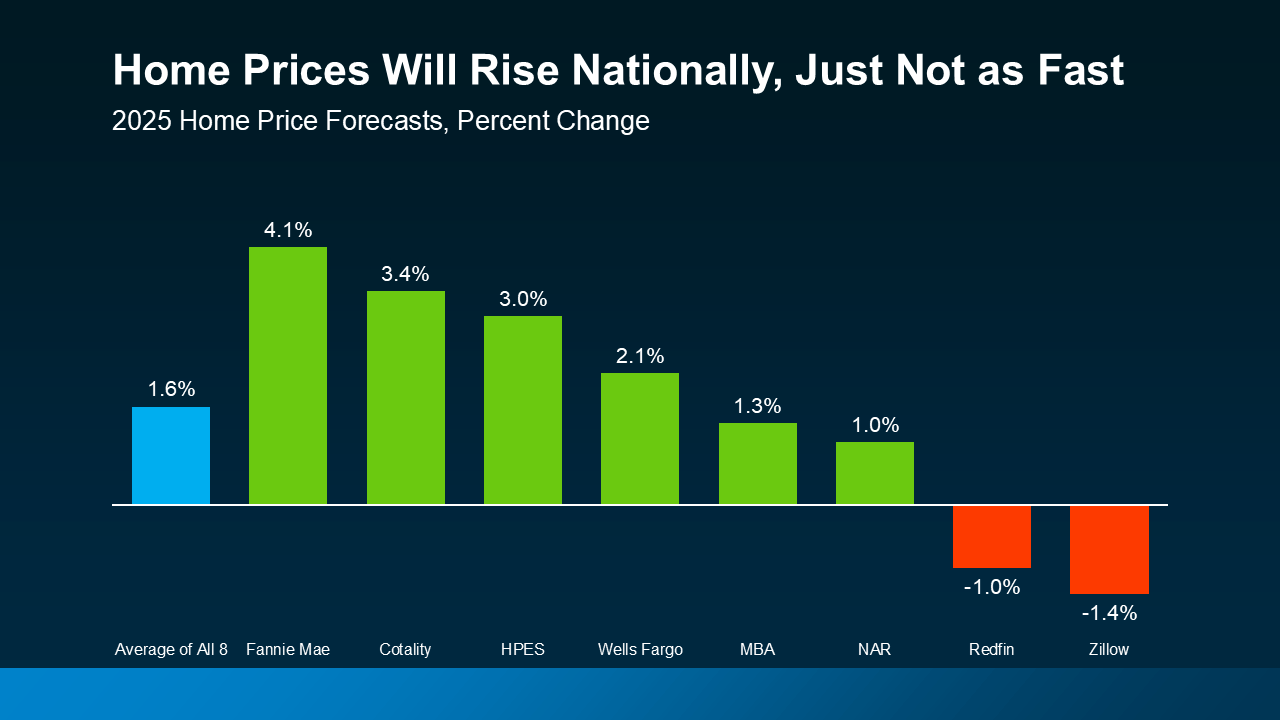

In fact, a national average of eight major forecasts shows home prices are still expected to rise 1.5–2% in 2025 :

So, Are Home Prices Going to Drop?

It’s a common (and valid) question, especially for buyers hoping for more affordability in a pricey market. And while you probably have seen headlines about prices dipping in certain areas, let’s zoom out and look at the bigger picture. Here’s what we know.Price growth is slowing down, but that doesn’t mean prices are falling off a cliff. According to the National Association of Home Builders (NAHB) :

“House price growth slowed…partly due to a decline in demand and an increase in supply. Persistent high mortgage rates and increased inventory combined to ease upward pressure on house prices.”

Translation? The market’s cooling, not crashing.

In fact, a national average of eight major forecasts shows home prices are still expected to rise 1.5–2% in 2025 :

So, if you're holding out for a big drop in home values, experts agree: it’s not likely to happen.

And while some local markets are seeing modest declines (averaging -3.5%), that’s nothing like the 20% drop we saw during the 2008 housing crisis. Plus, when you consider that home prices have jumped 55% nationally over the past five years (FHFA data), a small dip doesn’t reverse much of that growth.

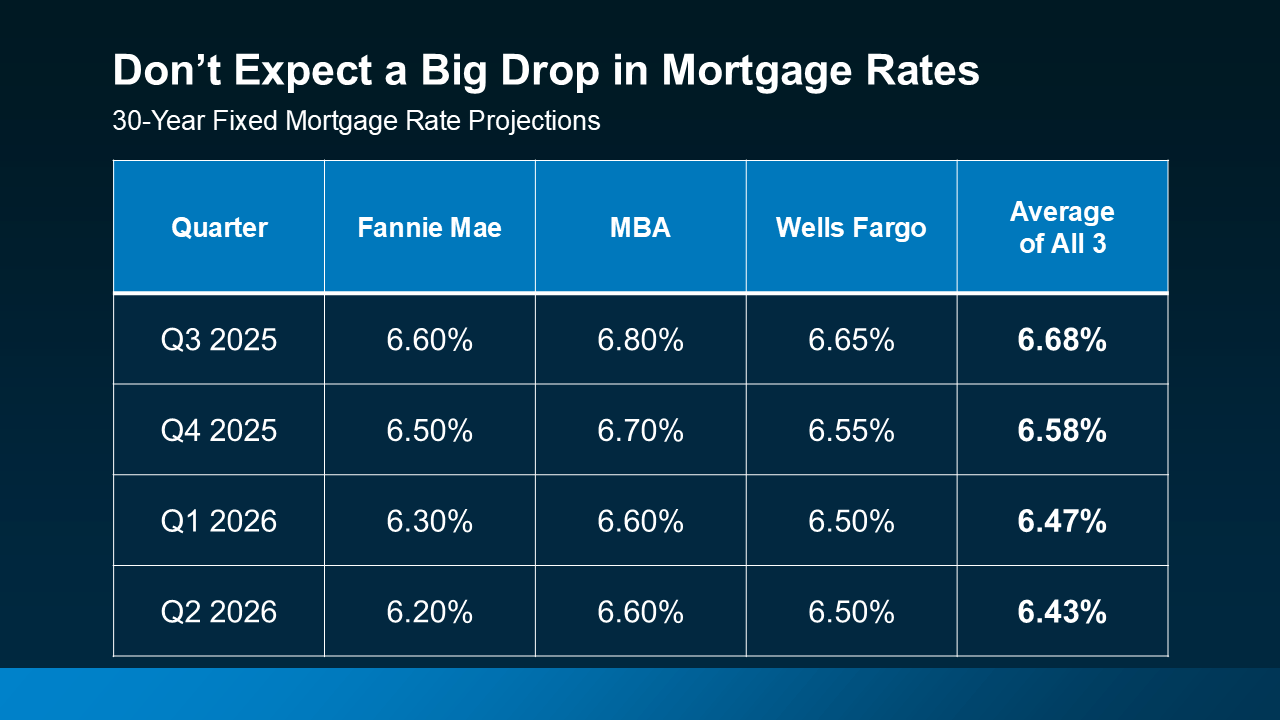

The latest projections from the Federal Reserve and leading economists show mortgage rates holding steady in the mid-6% range through to the end of 2025:

And while some local markets are seeing modest declines (averaging -3.5%), that’s nothing like the 20% drop we saw during the 2008 housing crisis. Plus, when you consider that home prices have jumped 55% nationally over the past five years (FHFA data), a small dip doesn’t reverse much of that growth.

What This Means for You

If you're waiting on the sidelines of homeownership, hoping for a major drop, you could be missing your window. Prices are expected to stay steady, or even inch upward, depending on your local market. Partnering with a knowledgeable mortgage and finance pro can help you understand what’s really happening in your area.Are Mortgage Rates Coming Down?

Another popular strategy we hear: "I’m going to wait for rates to fall before I buy." It’s understandable, but here’s why that could backfire. According to Yahoo Finance :“If you’re looking for a substantial interest rate drop in 2025, you’ll likely be left waiting.”

The latest projections from the Federal Reserve and leading economists show mortgage rates holding steady in the mid-6% range through to the end of 2025:

That’s close to where rates are today. So, if you're postponing your plans in hopes of a major rate drop, you might be waiting a while.

What This Means for You

Don’t let perfect conditions become the enemy of progress. If moving now supports your financial or lifestyle goals, let’s talk strategy. We’ll help you understand how to navigate today’s rate environment and what steps can give you more buying power.Inflation, job data, and Federal Reserve decisions can all impact rate movement. Having an expert in your corner who’s tracking those trends can make all the difference.

The Takeaway for Buyers and Sellers

This year’s housing market is more balanced than it may seem. Home prices are rising more moderately , and mortgage rates are projected to hold steady . Remember, this points to a market in transition, not turmoil.So whether you're buying your first home, moving up, or considering selling, making a smart move means focusing on your personal goals, not just the headlines.

Trying to time the market perfectly can leave you feeling stuck. Instead, let your own needs, timeline, and financial picture guide your decision-making.

At Luminate Bank, we’re here to help you make confident choices in any market. Connect with a local loan expert who can help you break down the numbers, understand your options, and plan your next step with clarity.