Moving On? Here’s How to Make This Market Work for Your Finances

webadmin • June 26, 2025

Moving On? Here’s How to Make This Market Work for Your Finances

If you're thinking about selling your home, there’s good news

: the housing market is settling into a healthier, more balanced place.

And while it might not sound exciting at first, this shift is actually a smart opportunity for sellers who play it right.

Over the past few years, we’ve all gotten used to fast sales, bidding wars, and sky-high prices. But that was the exception, not the rule. What we’re seeing now is a return to normal, and with the right approach, it can still work in your financial favor.

Here’s how sellers are winning in today’s market.

Over the past few years, we’ve all gotten used to fast sales, bidding wars, and sky-high prices. But that was the exception, not the rule. What we’re seeing now is a return to normal, and with the right approach, it can still work in your financial favor.

Here’s how sellers are winning in today’s market.

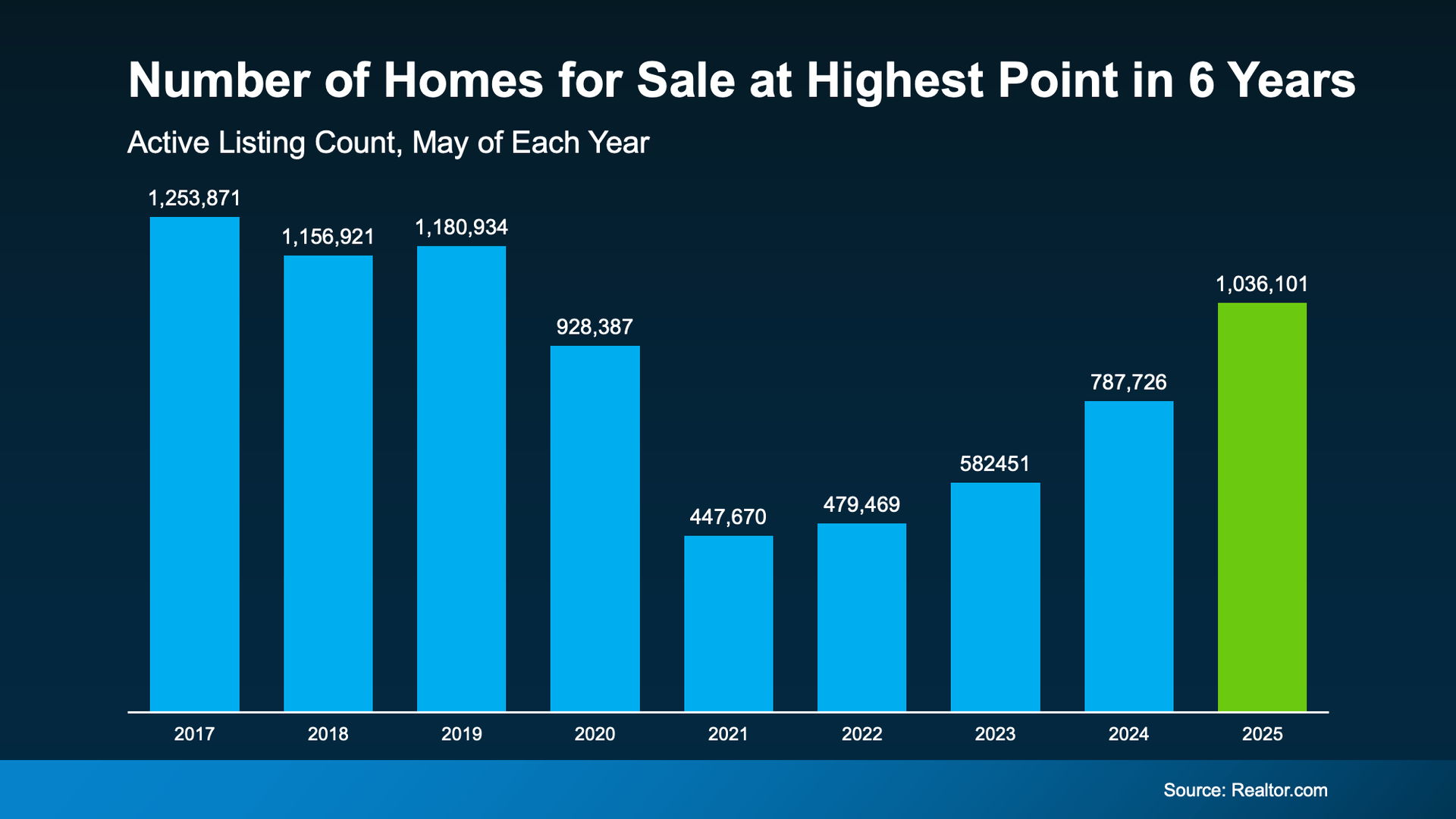

1. Inventory Is Up. And So Is Buyer Power.

The number of homes for sale is climbing back toward pre-pandemic levels. For you, that means your local market might look a little different than it did even a year ago. - In areas with more available homes, buyers have more options, and they’re taking their time.

- In markets where inventory is still tight, competition remains strong, and homes can still sell fast.

No matter where you live, your strategy matters. That’s where a trusted real estate expert comes in. They can help you adjust your pricing, timing, and marketing to match what buyers are looking for right now.

�55357;�56481; Luminate Tip: Thinking about how the sale of your home might impact your next financial move? Talk to a Luminate Bank mortgage expert to map out how the equity in your home could support your next chapter .

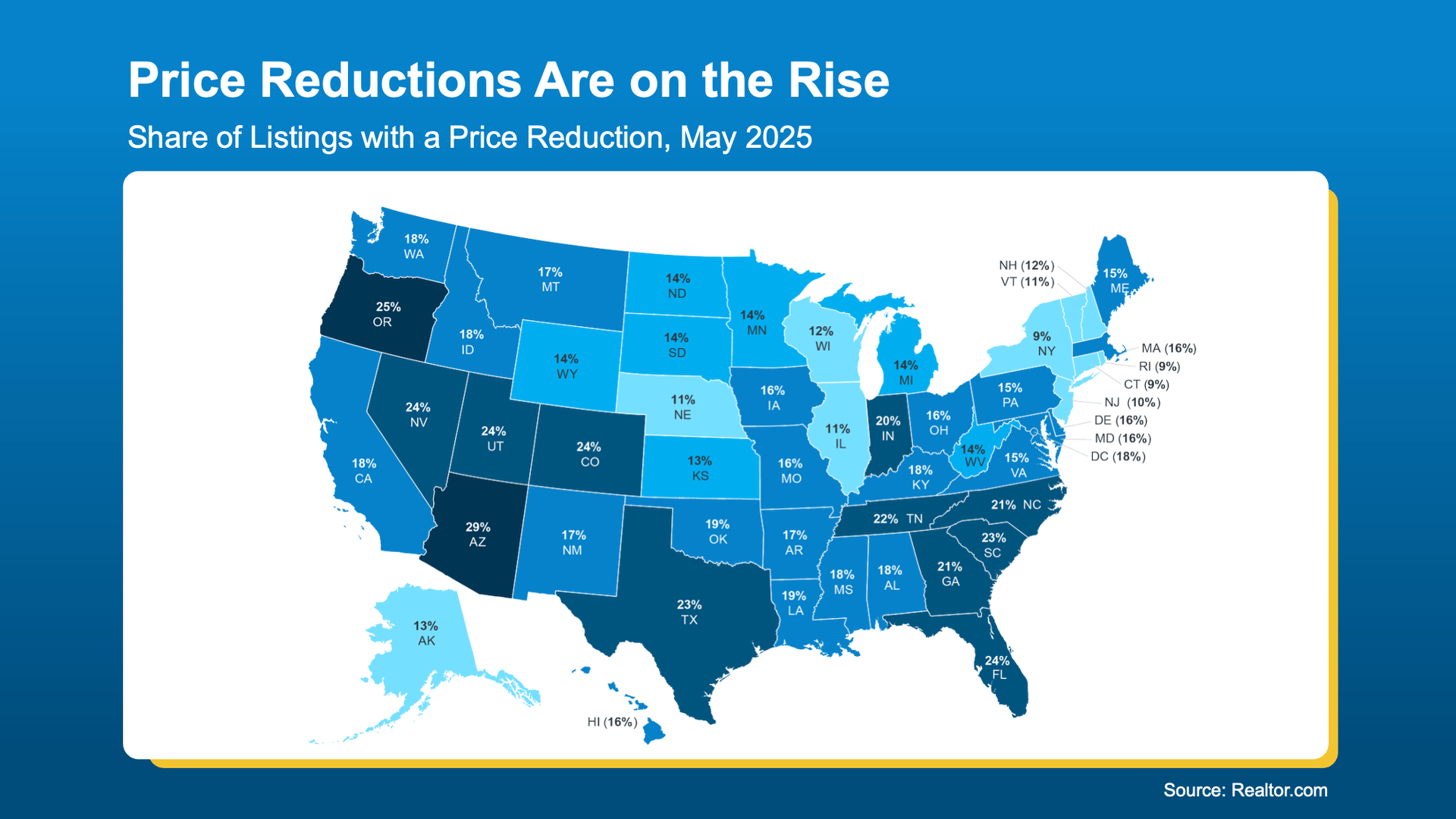

2. Pricing Strategically Is Everything

Buyers today are paying attention, and they’re not afraid to pass on homes that seem overpriced. In fact, nearly 1 in 5 sellers have had to reduce their asking price to stay competitive.

As Realtor.com puts it:

“A seller listing a well-priced, move-in ready home should have little problem finding a buyer.”

�55357;�56481; Luminate Insight: Your home is likely your largest financial asset. Getting the pricing right protects your equity and positions you for success on your next purchase. That’s smart money management.

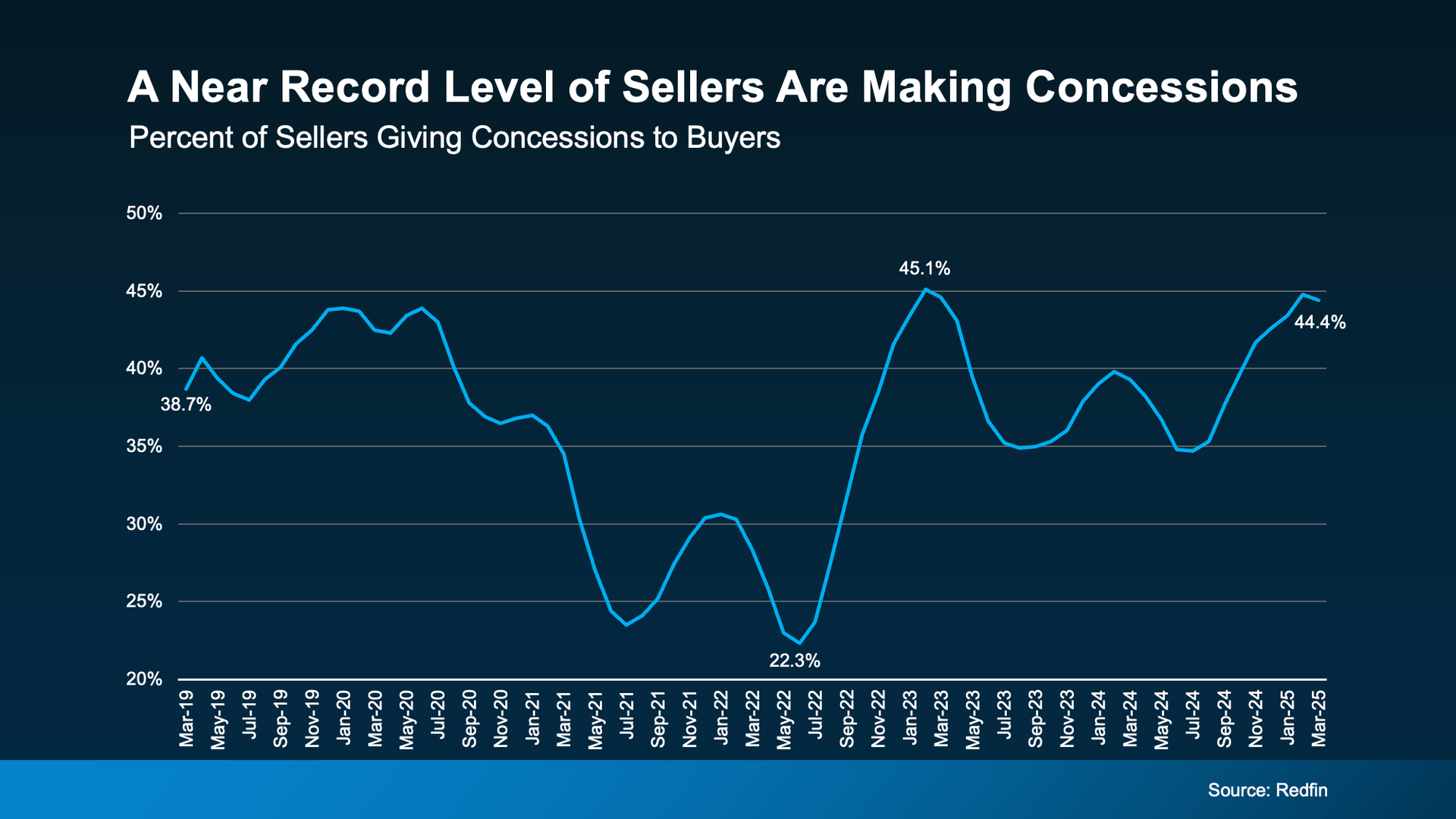

3. Flexibility Can Seal the Deal

Today’s buyers aren’t waiving inspections or throwing in wild offers just to compete. They’ve got options, and they’re using them. Repairs, credits, and closing cost help are all back on the table.

Redfin reports that nearly 44.4% of sellers are offering some kind of concession. That’s not a sign of a weak market; it’s a sign of a healthy one.

Offering a small concession can make a big difference and still leave you ahead, especially when you consider that home values have increased by over 55% in the past five years.

�55357;�56481; Luminate Reminder: If your goal is to walk away with the strongest financial outcome, flexibility is your friend. The right concessions can protect your timeline and keep your sale moving.

The Bottom Line

This market isn’t bad, it’s just balanced. And sellers who embrace that shift with the right mindset and expert guidance are still walking away with solid results.If you’re ready to talk strategy, Luminate Bank is here to support your entire financial journey. From leveraging your home equity to preparing for your next purchase, our experts are ready to help you make smart, confident moves.

Let’s talk about what’s happening in your neighborhood and how to make your next step a financial win.