Buying Your First Home? Here's How the Right Loan Can Make It Happen

webadmin • June 18, 2025

Buying Your First Home? Here's How the Right Loan Can Make It Happen

If you’re looking to buy your first home, it’s easy to feel overwhelmed, especially in today’s market. High home prices, rising rents, and

economic uncertainty

can make homeownership seem out of reach. But the truth is, there are

smart financing tools

out there that can open the door to your first home sooner than you might think.

One of the most powerful tools for first-time buyers? A Federal Housing Administration (FHA) loan. But it’s not the only one, and depending on your situation, there may be multiple loan options that help you move from renting to owning without breaking your budget.

One of the most powerful tools for first-time buyers? A Federal Housing Administration (FHA) loan. But it’s not the only one, and depending on your situation, there may be multiple loan options that help you move from renting to owning without breaking your budget.

Buying Your First Home Isn’t Always Easy (Financially Speaking)

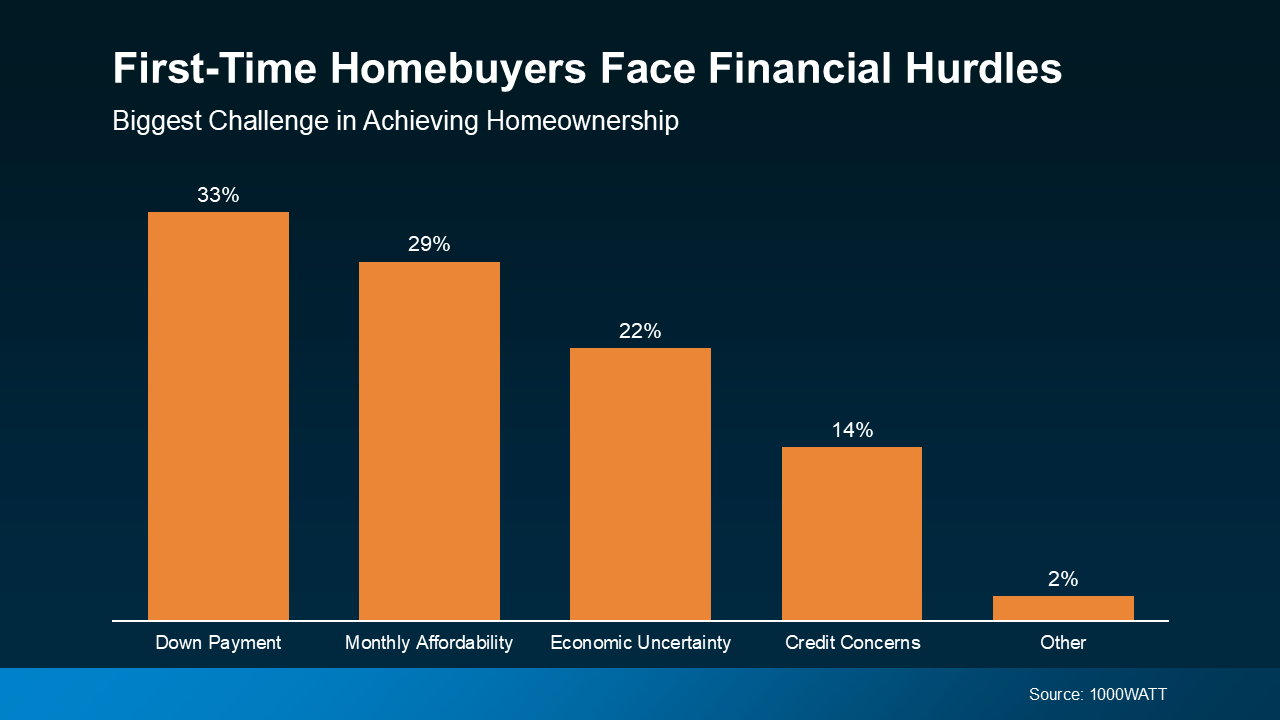

Let’s be honest: affordability is the biggest hurdle for first-time homebuyers. According to a recent 1000WATT survey, the top two financial worries are saving enough for a down payment and managing the monthly mortgage at today’s rates and home prices (see chart below):

That’s why it's more important than ever to choose a financing strategy that works for your goals

and

your wallet.

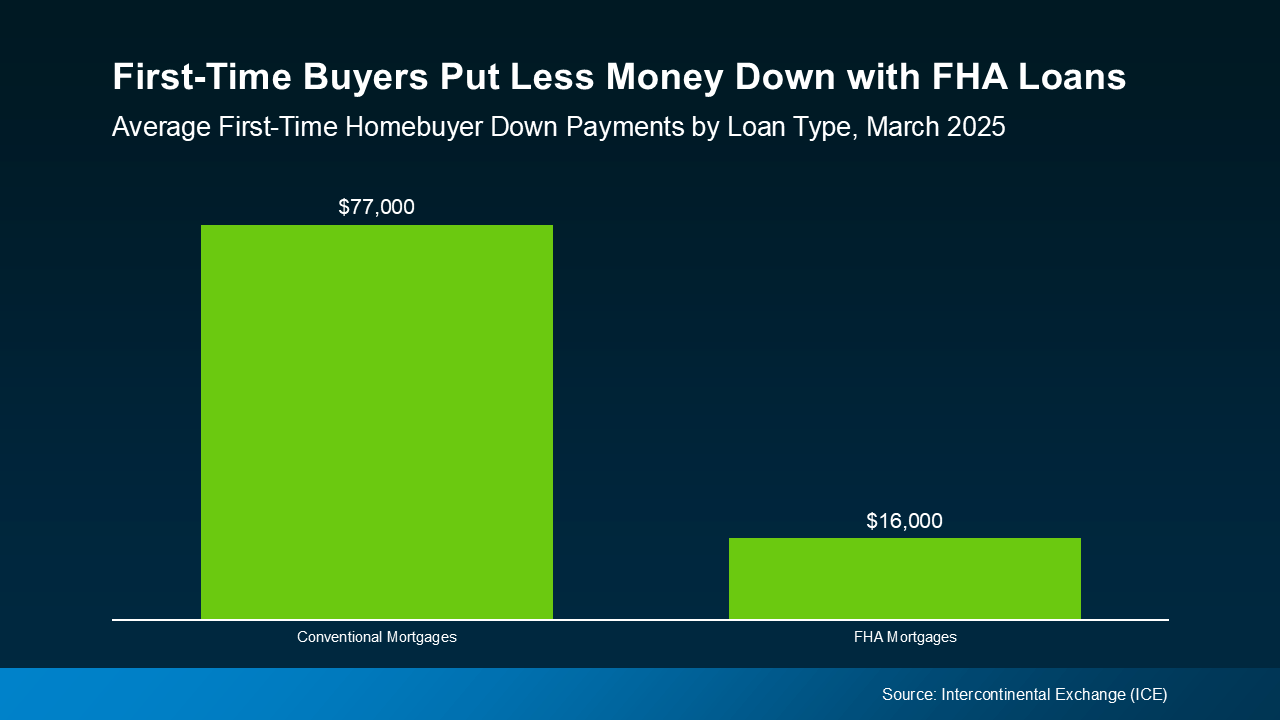

According to data from Intercontinental Exchange, the average down payment for first-time buyers using FHA financing is just $16,000 compared to $77,000 for a conventional loan (see chart below):

FHA Loans Can Ease the Financial Pressure

FHA loans were designed to help buyers who might not have perfect credit or a large down payment saved up. That’s why they continue to be one of the most popular options for first-time buyers.According to data from Intercontinental Exchange, the average down payment for first-time buyers using FHA financing is just $16,000 compared to $77,000 for a conventional loan (see chart below):

That difference can make or break your ability to buy a home, especially when you’re just getting started financially.

Lower upfront costs and potentially lower monthly payments? That’s a win-win for buyers looking to build wealth through homeownership.

And while FHA loans are a great option, they’re just one of several pathways to owning your first home. Depending on your income, location, or employment status, you may qualify for other options like:

The key is working with a trusted financial expert who can walk you through all your options and help you create a plan that supports your financial future, not just your home purchase.

When you work with a loan expert who truly understands your goals, you gain more than a mortgage, you gain a long-term partner in your financial journey.

More Than Just a Lower Down Payment

FHA loans often come with competitive (and sometimes even lower) interest rates than conventional options. According to Bankrate:“FHA loan rates are competitive with, and often slightly lower than, rates for conventional loans.”

Lower upfront costs and potentially lower monthly payments? That’s a win-win for buyers looking to build wealth through homeownership.

And while FHA loans are a great option, they’re just one of several pathways to owning your first home. Depending on your income, location, or employment status, you may qualify for other options like:

- Down payment assistance programs

- First-time buyer grants

- VA or USDA loans (if eligible)

- Low down payment conventional loans

The key is working with a trusted financial expert who can walk you through all your options and help you create a plan that supports your financial future, not just your home purchase.

Let’s Talk Strategy, Not Just Mortgages

At Luminate Bank®, we believe homeownership should be empowering, not intimidating. That’s why we focus on helping you understand all the financial pieces of the puzzle, from credit to closing.When you work with a loan expert who truly understands your goals, you gain more than a mortgage, you gain a long-term partner in your financial journey.