3 Housing Market Questions Everyone’s Asking This Season

3 Housing Market Questions Everyone’s Asking This Season

Holiday season conversations always seem to circle back to one thing: the housing market. Whether you’re chatting at a family gathering, the office holiday party, or catching up with friends, people are wondering what’s really going on, especially first-time buyers trying to make smart financial decisions.

To help you feel confident (and maybe even become the real estate expert at the table), here are the top three housing market questions people are asking right now with clear, fact-based answers.

1. “Will I even be able to find a home if I want to move?”

Short answer: Yes, and more than you could a year or two ago.

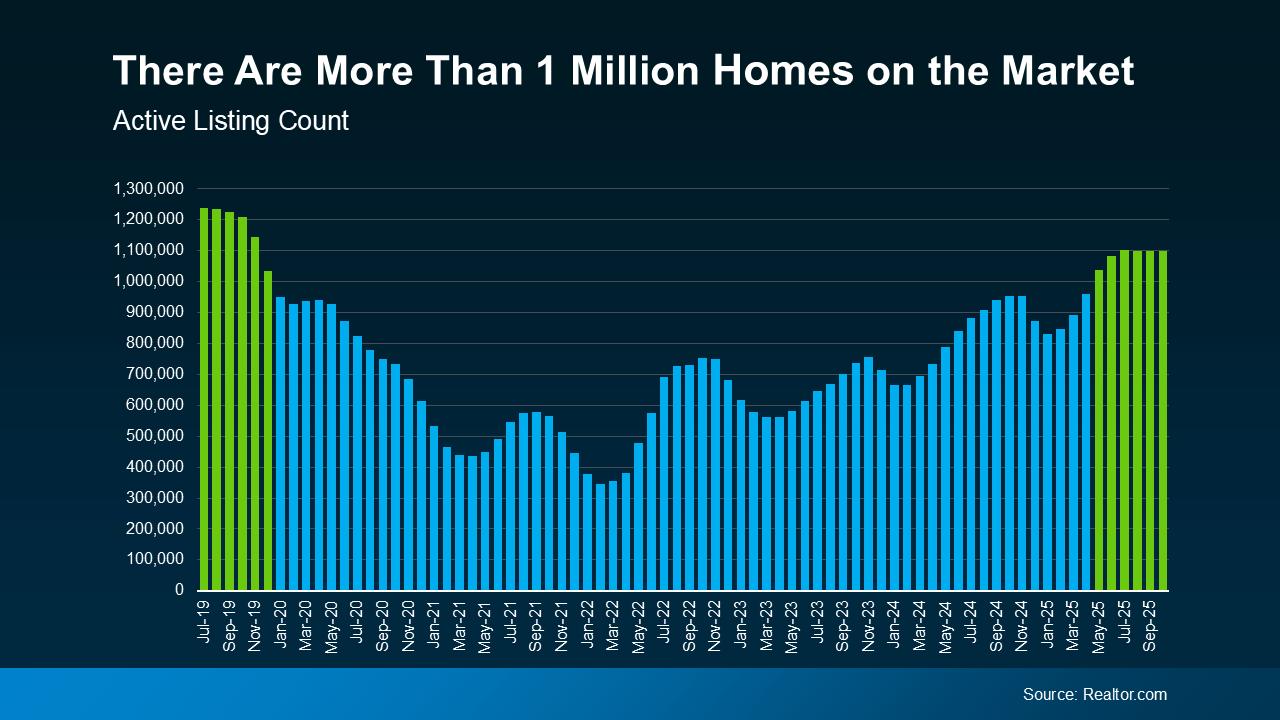

Housing inventory has been rising, giving buyers and sellers more breathing room. Realtor.com reports more than one million homes on the market for six straight months, something we haven't seen since 2019.

What this means for buyers like you:

- More homes to choose from

- Less competition for every listing

- More time to compare and make confident decisions

If you paused your search last year because nothing fit your needs, this is a very different landscape. Homes aren’t selling in minutes anymore, and that gives you the time and space to evaluate your options without pressure, especially if you’re a first-time buyer.

2. “Will I ever be able to afford a house?”

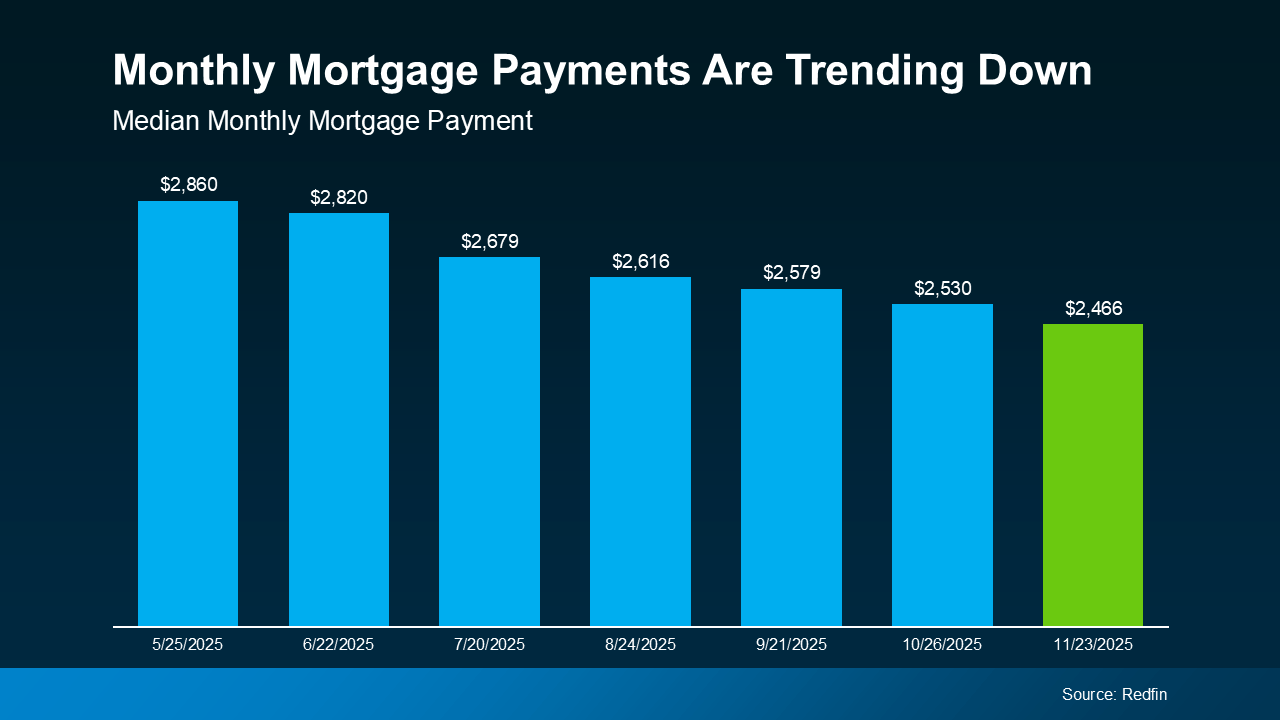

Here’s the good news: affordability is finally improving, and not just by a little. Two major shifts are helping first-time buyers get back into the game:

- Mortgage rates have been trending down

- Home price growth has slowed to a more normal pace

Together, these changes can reduce a monthly mortgage payment by hundreds of dollars compared to earlier this year.

Buying a home is still a meaningful financial step, but the numbers are becoming more workable for everyday buyers, especially those who are budgeting carefully and comparing payment scenarios.

3. “Should I wait for home prices to come down?”

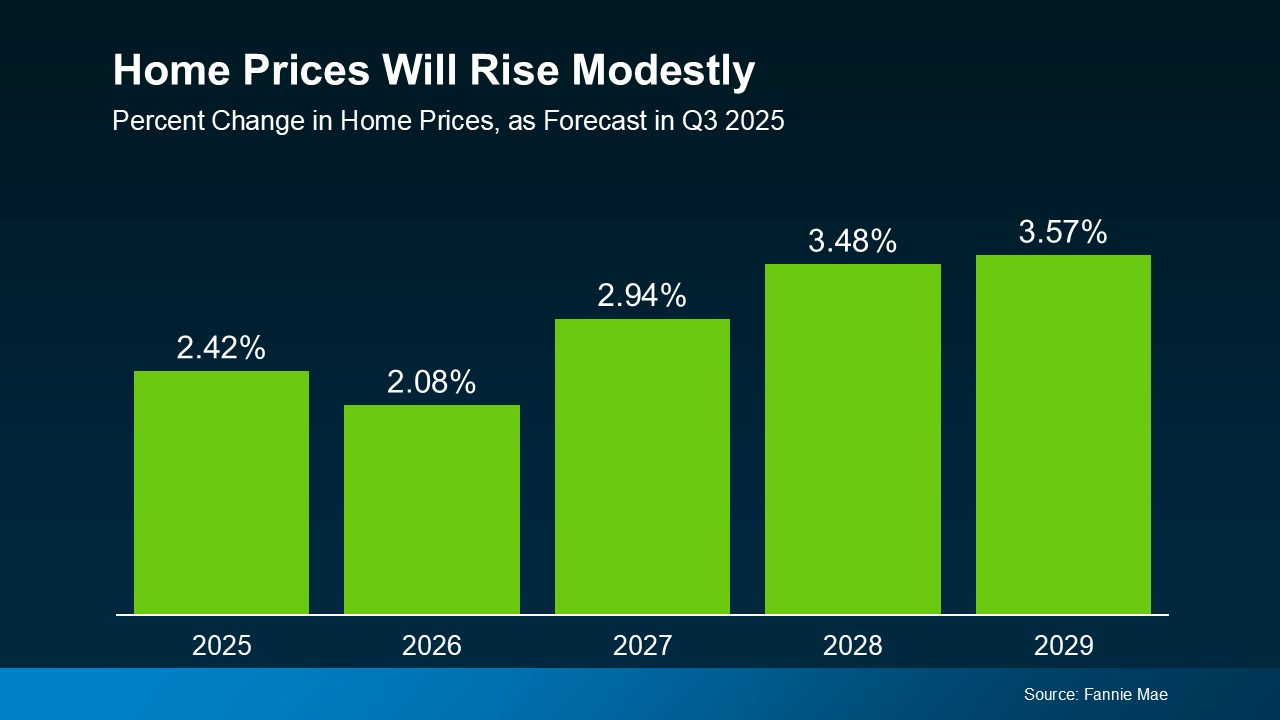

This comes up every year, but here’s the data-backed reality: a major nationwide price drop isn’t likely.

Even though inventory is growing, it’s not high enough to push prices down significantly. And unlike 2008, today’s homeowners have strong equity and solid financial stability.

Local markets vary, but nationally, economists surveyed by Fannie Mae expect home prices to keep rising, just at a slower pace.

Why waiting rarely works:

Trying to time the housing market is like trying to time the stock market: even the pros get it wrong. Historically, those who stay in the market build more long-term wealth than those who wait for the “perfect moment.”

If you’re renting, waiting may mean you’re simply paying more later for the same home.

Bottom Line

The housing market can feel overwhelming, especially when everyone has an opinion and begins arguing over the holiday ham. But the real questions come down to your goals, your budget, and your timeline.

If you want clarity based on today’s numbers and not headlines or rumors, let’s connect. We’ll walk through your options, look at real data for your local market, and help you build a confident plan for your next step.