What Credit Score Do You Really Need to Buy a Home?

What Credit Score Do You Really Need to Buy a Home?

Here’s a stat that might surprise you: According to Fannie Mae, 90% of homebuyers either don’t know what credit score lenders are looking for, or they assume it’s higher than it really is.

That means you might be closer to homeownership than you think.

When it comes to credit scores, there’s no one magic number that guarantees a mortgage. In fact, there’s a lot more flexibility than most people realize. Let’s break it down with some real numbers.

There's No One-Size-Fits-All Score

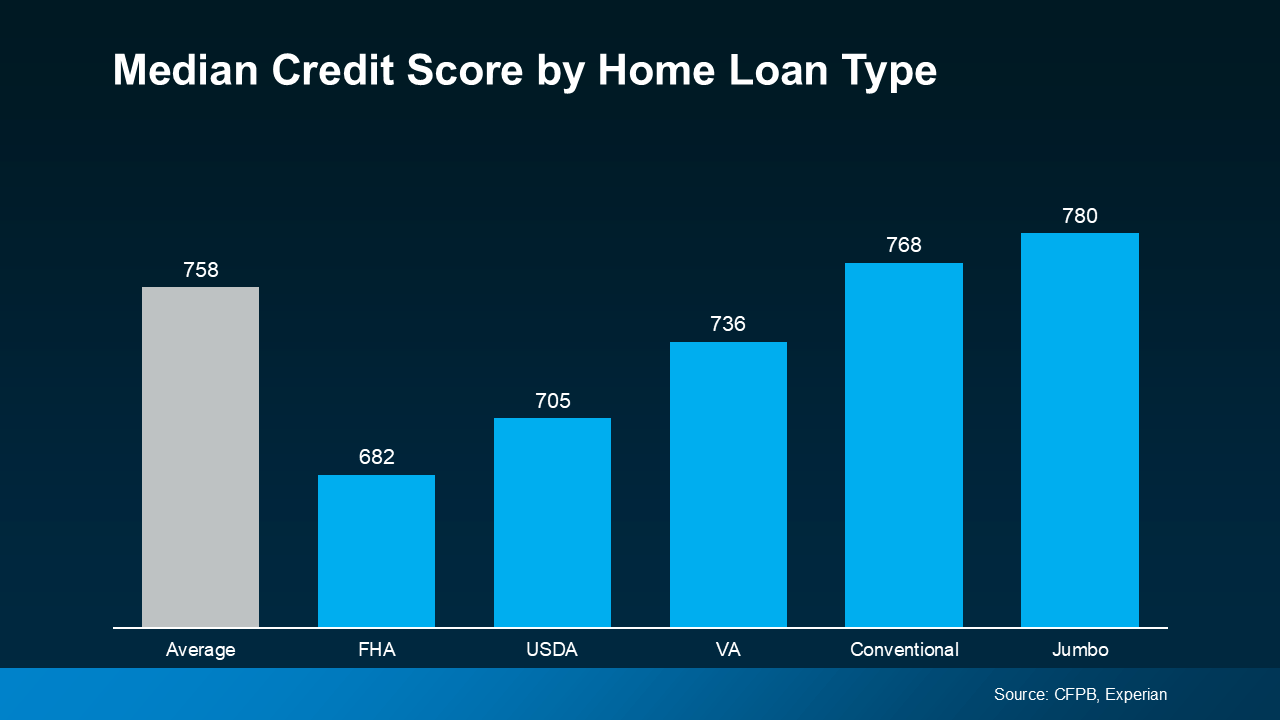

Your credit score plays a role in the type of loan you qualify for, but it’s not a pass/fail situation. This graphic shows the median credit scores of recent buyers across different loan types:

What does that tell you? There’s no single score that unlocks the door to homeownership. And that’s good news. Because you don’t have to be perfect, you just need to know your options.

As FICO puts it:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single ‘cutoff score’ used by all lenders, and there are many additional factors that lenders may use…”

Why Credit Still Matters

Your credit score helps lenders understand how you handle money, whether you pay bills on time, how much debt you carry, and how responsibly you use credit. It also plays a big part in:

- What loan types you qualify for

- The terms of your loan

- The mortgage rate you’re offered

And since your mortgage rate can affect how much home you can afford, it’s a key factor to keep in mind.

As Bankrate explains:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

But don’t let that stress you out. A less-than-perfect score doesn’t automatically disqualify you, it just means it’s time to explore what options are available.

Want To Boost Your Score? Start Here

Improving your credit score doesn’t have to feel overwhelming. It’s not about doing everything perfectly, it’s about making small, consistent moves that add up over time. Whether you're planning to buy a home soon or just want more control over your financial future, here are a few smart strategies to get started, straight from the Federal Reserve Board (with a little Luminate spin):

Pay Your Bills on Time

It sounds simple, but it’s one of the most powerful things you can do. Your payment history makes up a big chunk of your credit score. That includes credit cards, car loans, utilities, and even your phone bill. Set up auto-pay or calendar reminders if you need to. On-time payments show lenders you’re reliable.

Keep Your Balances Low

This is all about credit utilization, a fancy term for how much of your available credit you’re actually using. Ideally, try to keep that number below 30%. So if you have a $10,000 credit limit, aim to use less than $3,000. The lower your balances, the better your score can be.

Review Your Credit Reports

Mistakes happen. And even small errors (like a misreported late payment or an account that doesn’t belong to you) can pull your score down. You’re entitled to a free credit report each year from all three major bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com. Spot something off? Dispute it right away.

Don’t Open New Accounts Unless You Have To

Every time you apply for credit, it can trigger a hard inquiry, which might temporarily dip your score. Plus, opening too many new accounts at once can signal a risk to lenders. Focus on maintaining your current accounts and building a strong payment history instead.

Consider a Credit-Building Tool

If your score needs a bigger lift, you’re not out of options. Tools like secured credit cards, credit-builder loans, or even becoming an authorized user on someone else’s well-managed card can help you add positive credit activity to your report.

Bottom Line

Your credit doesn’t have to be perfect to become a homeowner. And chances are, your score may already be in a better place than you think.

The best way to find out where you stand? Talk to a lender who sees the full picture, not just the numbers. At Luminate Bank, we’re here to help you understand your credit, explore your options, and guide you confidently toward homeownership.