What the Numbers Say About Housing During a Government Shutdown

What the Numbers Say About Housing During a Government Shutdown

With the current and ongoing federal government shutdown, you may be wondering: “Does this mean the housing market completely stops in its tracks?”

In short, no; the market still keeps working.

Homes continue to be listed, contracts continue to be signed, and closings still happen. But what does change is that certain federal-processes may start to slow down, and this uncertainty can affect timing, decision-making, and opportunity for both buyers and sellers.

What’s Happening Now

When the government is shut down, many federal agencies either reduce operations or pause non-essential activity. In the housing finance world, that means there are a few specific areas that may face delays:

- Loans backed by federal programs such as Federal Housing Administration (FHA), Department of Veterans Affairs (VA), or United States Department of Agriculture (USDA) may encounter slower processing. These programs represent a notable portion of overall mortgage origination.

- Insurance and regulatory approvals, such as those tied to the National Flood Insurance Program (NFIP), may pause or backlog. Since many closings in flood-prone areas rely on flood insurance certification, this can stall some transactions.

- Because of the uncertainty, some buyers and sellers may delay moving forward, which can create short-term shifts in activity. Data indicates that when shutdowns occur, mortgage applications and endorsements drop.

Importantly, none of this means the housing market is frozen. It means you might see slight delays, more caution, or short-term adjustments.

What History Suggests, and Why This Time Might Be Different

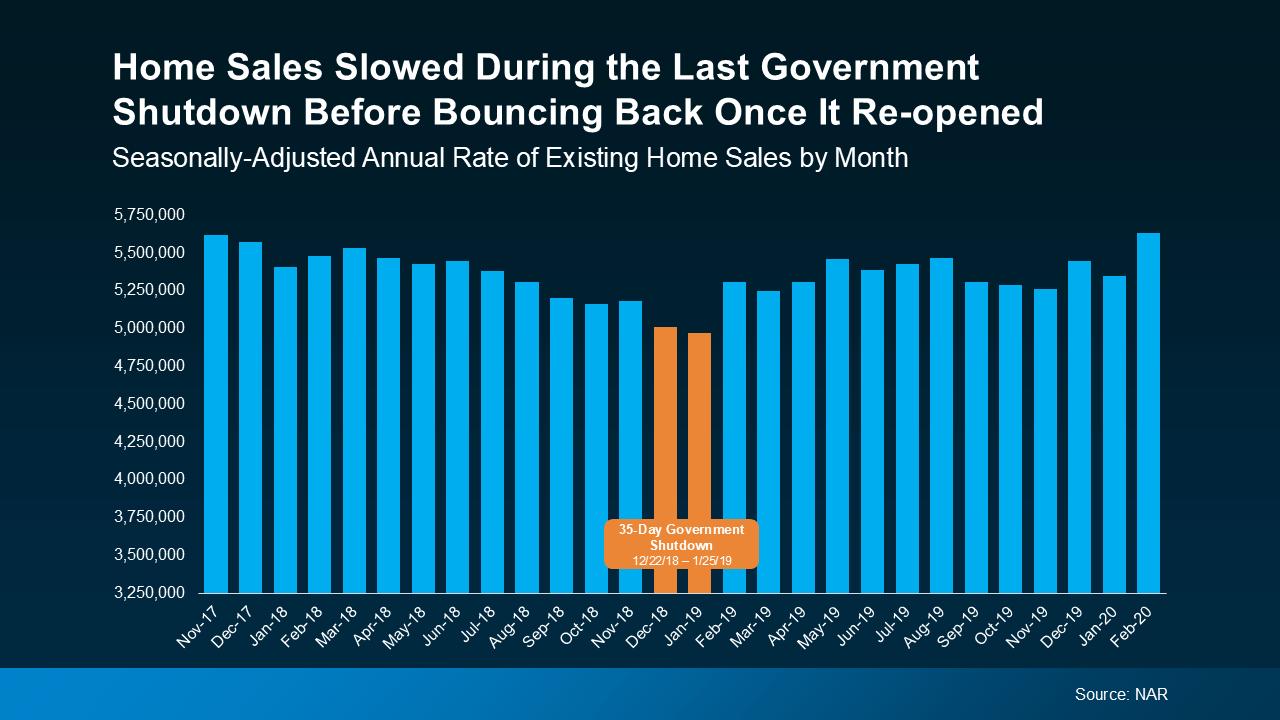

Looking back at previous shutdowns (e.g., the one at the end of 2018 that lasted 35 days), the housing market proved remarkably resilient.

Data from the National Association of Realtors (NAR) shows that existing home sales slowed slightly for about two months before rebounding quickly once the government reopened.

The dip you see in the orange bars wasn’t due to normal seasonality; it aligned exactly with the shutdown period. Once operations resumed, sales picked back up almost immediately as delayed closings cleared the pipeline.

While no two shutdowns are exactly alike, past patterns suggest any current slowdown is likely temporary: hopefully more of a pause than a problem.

How This Affects You Right Now

No matter where you are in the homeownership journey—be it a purchase or sale, or just starting to think about making a move—here’s what you should keep in mind:

- If you’re closing on your home soon and your transaction involves an FHA/VA/USDA loan or flood insurance, build in extra buffer time. A closing date might shift by a few days (or more) while the shutdown persists.

- If you’re just starting your home search, this could be a strategic moment for you. With many buyers pausing their search activity, there’s less competition in the market, meaning motivated sellers might be more responsive, and you might find more negotiating room.

- If you’re selling, keep in close communication with your agent and lender about deadlines and documentation; prompt action may help smooth potential slowdowns.

- If you’re purely a general buyer or seller (not needing a federally backed loan or special insurance), the market still functions. The impact is more in timing and mindset than market fundamentals.

The Bottom Line

The ongoing government shutdown does not mean the housing market halts; it just means some parts of the process may move a little slower, and the uncertainty adds an element of risk. Historically, markets return to their rhythm once federal services resume.

If you’re wondering how this might impact your timeline, especially at Luminate Bank, we’d love to talk and help you map out your next steps with clarity and confidence.