Don’t Let Unrealistic Pricing Cost You Your Move

Don’t Let Unrealistic Pricing Cost You Your Move

These days, getting your list price right is more than a real estate tactic, it’s a financial strategy that impacts your home equity, future affordability, and long-term goals.

It’s easy to think: “Let’s price high and see what happens.” But in today’s shifting market, that strategy can backfire fast, costing you time, leverage, and in some cases, your next move entirely.

The Hidden Cost of “Testing the Market”

Many homeowners remember what a neighbor’s house sold for back in 2021 or 2022 when bidding wars were fierce and homes sold in days. But the market has changed.

Today, there are more listings, fewer bidding wars, and smarter buyers who are shopping within tighter budgets. They’re looking closely at mortgage rates, monthly payments, and the total cost of ownership, not just sticker price.

As Lisa Sturtevant, Chief Economist at Bright MLS, explains:

“Buyers will have more leverage in many, but not all, markets. Sellers will need to adjust price expectations to reflect the transitioning market.”

That means the “test-the-market” mindset often leads to longer days on market, price reductions, and lost buyer confidence.

But here’s the good news: even after accounting for a market adjustment, the average homeowner has built significant equity. According to the Federal Housing Finance Agency (FHFA), home values have increased by 54% over the past five years.

Financial Reality Check:

You might not sell at the peak price your neighbor got, but odds are you’ll still walk away with a healthy profit, especially if you’ve been in your home for more than a few years.

Why Overpricing Can Freeze Your Finances

When your home sits on the market too long, it doesn’t just stall your plans, it also impacts your financial momentum:

- Carrying costs add up. Each extra month means another mortgage payment, utilities, insurance, and property taxes.

- Your buying power shrinks. If rates rise while you wait to sell, your next mortgage could cost more.

- Your home equity is tied up. That’s money you can’t use for a down payment or to strengthen your next move.

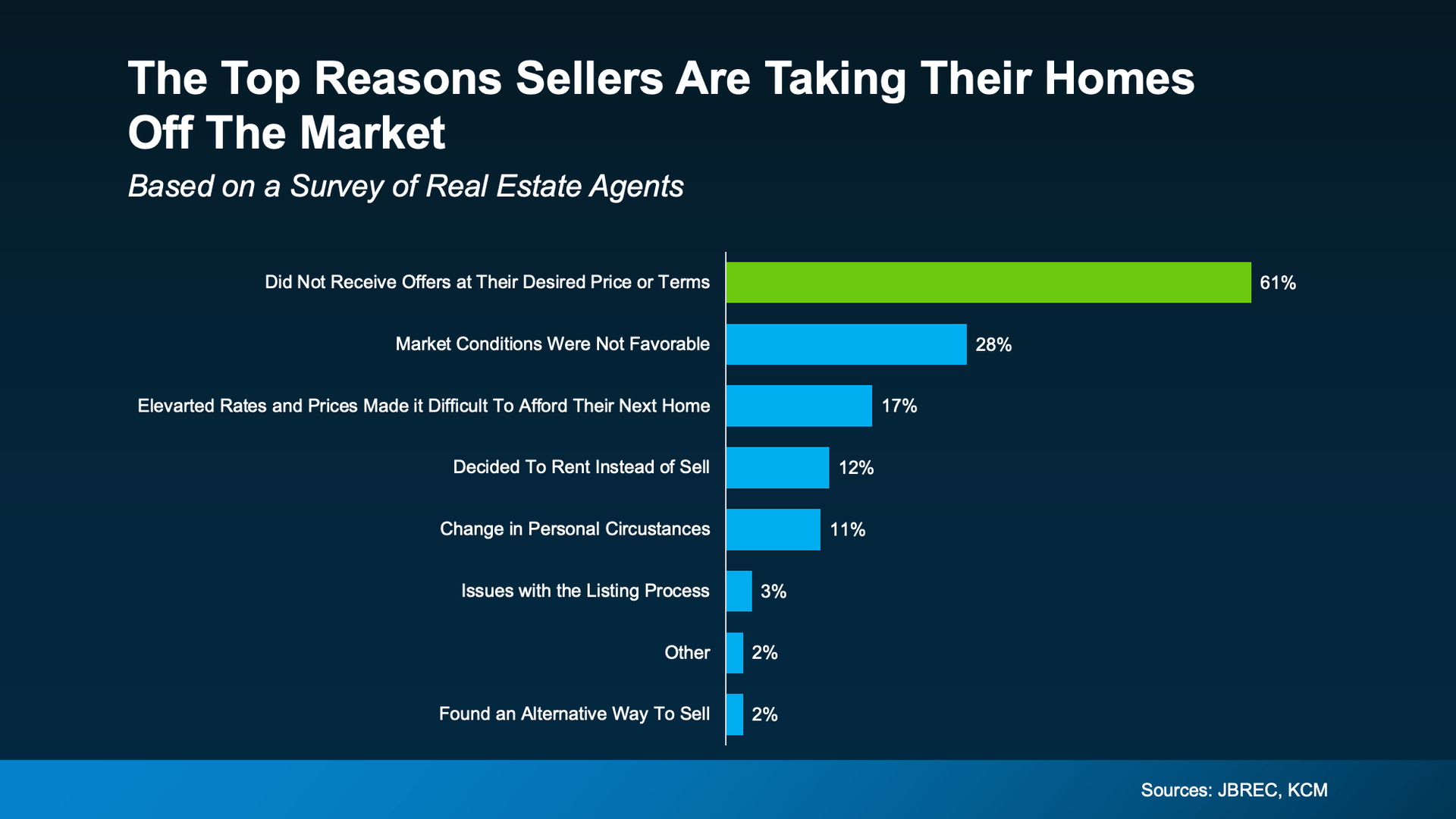

According to a recent JBREC & Keeping Current Matters survey, 54% of agents say more homes are being delisted because sellers didn’t receive the offers they hoped for.

“Sellers holding onto high price expectations is the leading reason they are delisting their homes.” – JBREC & KCM Survey

And Bright MLS data echoes that finding:

“Sellers are delisting after having their home on the market and finding they are not getting the price they hoped for.”

When that happens, you’re not just losing buyer interest, you’re losing financial opportunity. Every extra month off the market delays your next purchase and can even affect your loan approval timeline.

The Smart Seller’s Strategy

If your goal is to move closer to family, upsize, downsize, or relocate for work, pricing strategically is key to keeping your financial goals on track. Here’s how to do it:

- Work with a local agent who knows real-time buyer behavior, not just last quarter’s comps.

- Ask your lender for an updated net proceeds estimate so you understand what you’ll walk away with after costs.

- Check your purchasing power early. A lender can help you understand how your equity can fuel your next home purchase or investment opportunity.

Pro Tip: Even a small price adjustment early on can make a big difference, not only in attracting buyers but in freeing up your equity to start earning interest or reducing debt elsewhere.

Bottom Line

Pricing your home right isn’t just about attracting offers; it’s about protecting your equity, minimizing financial drag, and positioning yourself for what’s next.

If you’re thinking about selling, let’s talk through what buyers are really paying in your area and what that means for your next move, whether that’s your next home, a refinance, or a stronger financial foundation.